Today, we all are highly reliant on money. We cannot survive without it. The amount of money we have decides what we eat, how much we eat, where we live, what we buy, and it controls our life for us. Unfortunately, children often do not know the true value of money. Growing up, parents earn and spend on their kids. Due to this, kids do not understand the effort that goes into earning, nor do they know the importance of saving money. This is where neo banks for teens come in.

Often, teens may feel saving a few rupees a month is enough savings for the month. However, it is only after they start earning on their own and become independent do they realize the true value of money and the importance of saving it. Unfortunately, it may become too late to change their spending habits by then, and they may face huge problems.

Therefore, it is important that we must impart financial literacy to our children as early as possible. We must teach them the significance of saving and how to spend their money. In addition, they must know how to differentiate between their wants and needs to spend their money efficiently.

What is a neo bank?

A neo bank is an online bank. Most of these banks don’t exist physically and are purely online. Neo banks generally do not have banking licenses but depend on partnerships with actual banks to provide those licenses. You can store your money in neo bank accounts or wallets by transferring your money through UPI transactions, debit cards, etc.

What are some features/facilities provided by neo banks?

Some of the features/facilities of neo banks include:

- They issue neo cards or debit cards for their users

- They allow users to make online payments through their apps

- They provide regular discounts on various purchases

- They often have blogs and other features to impart financial literacy

- They keep a record of their customers’ purchases

- They allow customers to limit their spending to a certain amount

Today there are many neo banks that people can use. While some neo banks are open for everyone, other neo banks target specific people. For example, certain neo banks target working professionals while others target teenagers. With the wide variety of choices, the right one for you becomes confusing. Here are our picks top 10 best neo banks for teens.

Top 10 Best Neo Banks for teens

1. Fyp

Fyp is a teen exclusive neo bank that allows users to spend money independently. This gives teens some financial control and prepares them for an independent life. Fyp offers teens a chance to spend on themselves all on their own. This helps teens get an idea of how to manage their money efficiently, which prepares them for the future when they earn for themselves.

Fyp helps you budget your finances and helps you save your money. It offers great cashback on most of your expenditures through the Fyp app or Fyp debit card. These cashback are instantaneous, so you don’t have to wait. Teens get cashback on almost every Fyp app or debit card purchase. One reason Fyp is at the top of the best debit cards for teens is its variety of services. Fyp encourages financial literacy in many ways. While the primary way is to give some financial control to teens, there are other ways.

Fyp has a blog with many informative articles on various financial topics for interested teens. The Fyp app also has short informative slides that teens can read to improve their knowledge.

Teens can buy Netflix subscriptions, Spotify Premium subscriptions, fast food from restaurants like Burger King, order food online from Zomato and buy electronics from BoAt. Using the Fyp issued debit card for teens, they can also go to their favourite stores and buy clothes, buy a movie ticket or purchase groceries. Fyp is extremely safe and reliable. The Fyp debit card doesn’t have sensitive details on it, the app is secured with a code, and the card can be blocked easily if lost or stolen. Users can also track transaction details through the app.

Fyp might be a neo bank for teens, but it also understands that teens may not make the best decisions for money. Hence Fyp lets parents have some control over their children’s expenditures. Parents can transfer the money to their teen’s account. In this way, parents can provide their monthly allowance to kids on the app itself and ensure that their children aren’t spending more than needed. You can transfer up to 1,00,000 rupees a month to the Fyp app.

There is no charge to use Fyp. The registration is free, and you do not need to spend any money on it. However, one will have to incur the only cost to buy the Fyp debit card for teens. Of course, if you want to spend money from the Fyp app or debit card, you will have to transfer your own money to the app first. However, Fyp does not charge any service fee from its customers.

Using Fyp is very simple. Being a teen neo-bank, Fyp realizes that everything needs to be quick and convenient. Hence using Fyp is fast and convenient too! To register, all you need to do is download the Fyp app from Play Store/Appstore and register yourself there. Once you enter your details, you will have your account. You can then start spending money on things you need. You can then buy a debit card for teens for a small fee.

Fyp allows its users to use their debit cards and UPI payment options to put money into the Fyp app for them to use. However, the Fyp app only allows users to put money in their Fyp account using their UPI ID, but it does not allow users to make payments through the Fyp app using UPI yet, through this feature will be rolled out soon according to the company.

2. Greenlight

Greenlight is another one of the top 10 best neo banks for teens. While the previous neo banks were all Indian, Greenlight is an American neo bank. It provides the Greenlight debit card for teens. Even though it is aimed at teens, it has no age restrictions and can even be used by adults. Greenlight can be used internationally in many countries. The Greenlight debit card is a Mastercard and can be used in those countries that accept Mastercards. However, there are a few countries where users cannot use their Greenlight cards.

The major difference between Greenlight and the previous cards is that Greenlight does not offer free services to its users. Instead, those who opt to use greenlight cards must pay a monthly fee depending on the plan they choose. There are three available plans. They include the monthly $4.99 plan, $7.98 plan and $9.98 plan. Teens can also customize their debit cards with pictures of them or other things on them.

Greenlight also lets parents have some control over their children’s expenditures. Like the neo banks mentioned before, Greenlight also requires parents to deposit money into the app. Thus, too, parents can provide their monthly allowance to kids on the app and make sure that their children aren’t spending excessively.

In addition to the debit card facilities. Greenlight has a lot more! Those who opt for the $7.98 and $9.98 plans can also invest. Parents or children under their supervision can invest in stocks and ETFs. If children are trading, they require their parents’ approval for every trade. While one needs to pay for the stocks they buy, the app charges no trading fee.

Additionally, to encourage savings, kids who use the $9.98 plan can earn some interest on the money they have at the end of the year. Greenlight also incentivizes referrals. Thus, greenlight users who refer their friends get $30 for the 1st, $50 for the 2nd and $70 for the 3rd referral.

3. gohenry

Another one of the best neo banks for teens is gohenry. Like the previous neo banks, gohenry is also a neo concept. It offers prepaid debit cards for kids of all ages. gohenry, like Greenlight, is a foreign brand based out of London. Though aimed at kids and teens, gohenry can also be used by adults. Like Greenlight, this too can be used internationally. The gohenry debit card is a Visa card and can be used in those countries that accept Visa cards. The cards can be customized, and users can choose from various choices.

gohenry lets parents get regular updates about their child’s activities on the app. Like the other neo companies, parents can deposit money into their child’s accounts for them to use. However, while the others require parents to transfer the sums every time they want, gohenry allows parents to set up weekly allowance transfers. This means that once parents set this, their child’s account will regularly receive a fixed, pre-determined sum of money.

gohenry seemingly provides more parental control than the other apps. For example, parents can immediately transfer money to their kids whenever needed, and they get real-time notifications every time their child spends money or the card is declined. Additionally, parents can block or unblock the card whenever they want. Further, no matter the amount of money deposited, parents can still determine where and how much kids can spend.

gohenry supports savings, so the app allows parents and kids to set savings goals and track their savings. The gohenry app also has many videos and quizzes to learn various financial skills. Upon completing missions from the app, kids get points and badges. Some of the topics here include Money basics, Jobs & earnings, Saving habits, Spending wisely and Helping others. In addition, parents can set tasks for their kids on the app, and kids can then be paid once they complete those tasks.

Besides this, the gohenry app rewards its users for every referral they make. So if a user recommends gohenry to someone who then starts using the app, they can earn some money. One important thing to keep in mind is that gohenry, unlike Fyp, is not free. While users can use it for free for the first 30 days, they must pay £2.99/month.

4. FamZoo

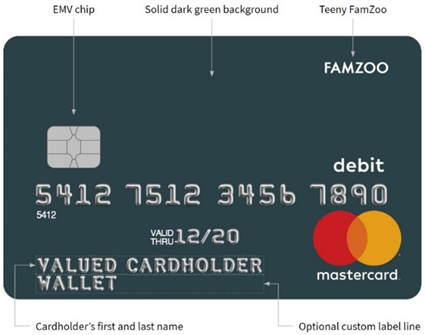

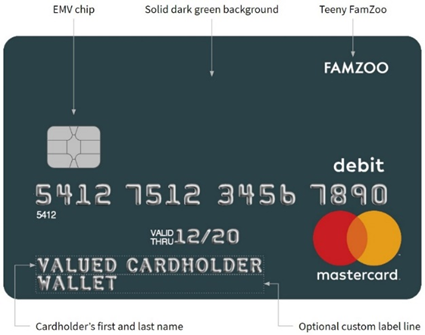

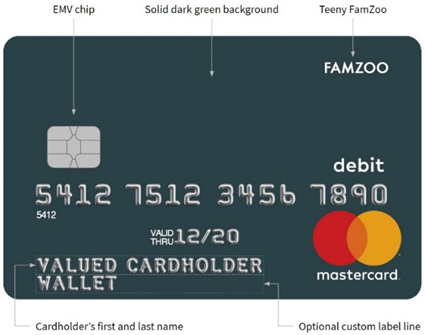

FamZoo is another one of the best neo banks for teens. Like Greenlight, FamZoo is an American company that offers prepaid debit card services for kids. However, unlike all the above services that are targeted only at teens, FamZoo is targeted at families as a whole. Hence, everyone can use FamZoo.

It is a virtual bank that functions as a private online family banking system. It allows parents to teach kids to earn, save and spend money wisely. Like a few of the above applications, FamZoo also enables parents to set automated allowances that go to kids’ accounts at regular intervals. FamZoo has two types of accounts, prepaid accounts and IOU accounts. Prepaid accounts work like a normal account. Here, parents deposit money in their child’s account and the child can then spend the money. IOU accounts are a little different.

These accounts are only used to track money that is held elsewhere by parents. In a sense, it shows the amount of money owed by parents to their child in the form of pre-determined allowances or payments in case parents have not given them to the child yet.

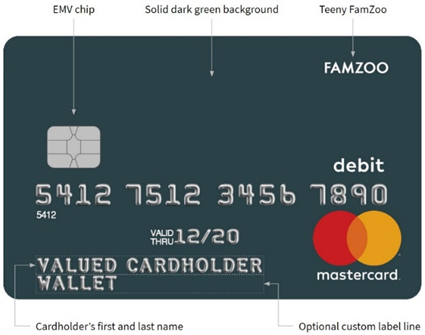

To get a FamZoo debit card, an adult must pass an online adult verification process, while those under 18 must pass an online teen verification process. If a child is 12 or younger, the parent is the legal cardholder. Parents get “on-behalf-of” cards to make purchases on a pre-teen’s behalf. On-behalf-of cards and their transactions can be seen on the FamZoo app.

FamZoo cards have certain limits. One can make a maximum of 99 loads or load up to $2500 per day. The total card balance and maximum expenditure on a single transaction are $5000. At the same time, the maximum ATM withdrawal limit is $510. FamZoo is not a free service. You have to pay to use it. While it charges $5.99 a month, you get discounts for the six months, 12 months or 24 months subscriptions.

Parents here can closely supervise their child’s spending habits. They get detailed information when purchases are made and even when the card is declined. Further, parents can also set chores for their kids and assign a monetary value to incentivize them. Additionally, parents can also give financial penalties to kids for not doing their chores. Parents can also pay children some interest if they save money regularly.

5. Cooper

Another one of the best neo banks for teens is Cooper. Like the previous neo banks, Cooper is also a neo concept. Like, Greenlight, it is an American company that offers prepaid debit card services for kids. Cooper offers prepaid debit cards for kids of all ages. In order for teens to get a card, their parents must register them on the app. The Cooper debit card is a Mastercard that can be used to make purchases. The Cooper card can be used internationally in all those countries that accept Mastercards. Cooper also provides a virtual debit card. While the physical card can be used to make online and offline purchases, the virtual debit card can only make online purchases.

Cooper emphasizes on imparting financial literacy to teens. It teaches them topics like the importance of economic health, saving for the future, budgeting and spending wisely, and setting goals and reaching them. Cooper is very safe and uses encryption and authentication to protect its users’ accounts. It is also FDIC insured, and users’ money is insured up to $250,000.

Cooper lets parents have some control over their children’s expenditures. Only parents can transfer the money to their teen’s account. It also allows them to monitor purchases made by their teens and set up allowances to pay their teens for doing chores. However, Cooper has some limits on the transactions it allows. It currently has a $500 daily load limit, a $2,000 monthly load limit and a $2,000 daily spending limit. Additionally, Cooper incentivizes referrals. If a person refers their friend to the app, they both get $3 as long as they use the referral link.

6. Mydoh

Another one of the best neo banks for teens is Mydoh. It is a neo bank for kids and parents. Mydoh is a Canadian company that offers prepaid cards for kids. Kids of all ages can use the app. It aims to impart financial literacy to teens.

In order to make an account, parents need first to download the app and register themselves. They then need to invite their kids to the app and sign them up. After that, the kids can get the Mydoh Smart Cash Card which they can use in order to spend money. The card can be used for online or offline purchases. The Mydoh card is a Visa card that can be used everywhere a Visa debit card is accepted. It can also be used internationally in those countries that accept Visa cards.

Mydoh lets parents have some control over their children’s expenditures. They can also control various other aspects using the app. Parents can set up tasks and allowances, send kids money, track earnings and spending, as well as lock and unlock the card. Kids can learn various aspects of money using the app. They can manage their tasks, use their card to make purchases, track their earnings and spending and check their balance. This allows them to learn to understand where and how to spend money effectively.

Mydoh has tasks and allowances that parents can use. Here they can provide monthly allowances as well as set tasks for kids. The kids can get a certain amount of money on completing the tasks. The app also has Mydoh Play. This aims to make learning about money easy. Kids learn about money and gain financial literacy through trivia.

7. Osper

Osper is another one of the best neo banks for teens. Osper is a British neo bank that is aimed at kids. It helps teach children to spend and save pocket money wisely. There are 2 Osper apps, one for children and the other for parents. The app for children lets them use the money given to them while parents allow them to control and monitor their child’s activities.

In order to make an Osper account, parents need to download the app and register themselves. After this, they need to register their kids and activate their Osper cards together. Children of UK citizens can only use Osper. The Osper debit card is a Mastercard that can be used to make purchases wherever Mastercards are accepted. However, the Osper cards cannot be used for services like gambling, some establishments which serve alcohol and dating services.

It lets parents have some control over their children’s expenditures. For example, only parents can transfer the money to their teen’s account. In this way, parents can provide their monthly allowance to kids on the app itself and make sure that their children aren’t spending more than needed. Parents can also lock the card if it has been lost or stolen.

Osper allows children to save money towards their goals regularly. The app also provides them with detailed information regarding their transactions. For example, they get notifications regarding all deposits made into their account and spending. The app is free to use for one month. However, after this, it costs £2.50 per month for each child that uses the app.

8. Pixpay

Another one of the best neo banks for teens is Pixpay. It is a French neo bank that is aimed at kids. Like Osper, There are 2 Pixpay apps, one for children and the other for parents. The app for children lets them use the money given to them while parents allow them to control and monitor their child’s activities.

Parents can use the app to provide regular allowances to kids. This makes it easier to give them their monthly pocket money. This is because they can set the amount to be given, and then the money gets transferred automatically every month. Additionally, parents can also make one time payments to their kids. The app allows parents to set missions for their children. On completing such missions, parents can reward kids with some money. This encourages kids to do their chores.

Parents can also set limits to how much their kids can spend at once. Additionally, the children can only spend their money in their accounts. This means that there will not be any overdrafts. The Pixpay debit card is a Mastercard that can be used to make purchases wherever Mastercards are accepted. The card can also be used abroad in all countries that accept Mastercards.

9. Rooster Money

Rooster Money is another one of the best neo banks for teens. It is another one of the British neo banks aimed at teens.

Rooster Money helps children gain financial literacy and targets kids aged 4 to 17. Unfortunately, the Rooster card is only available to those in the United Kingdom.

Parents can control and oversee their child’s financial activities. They can also incentivize them to complete tasks and do their chores by providing them with stars for completing them. Based on the stars they get, the kids can then be given their pocket money. Kids can also check their stars using Alexa by asking it how many stars they have.

Rooster money aims to make kids financially aware and impart financial literacy to teens. The Rooster Money website has a blog with many articles that provide knowledge to kids about how to spend and save money as well as other current financial matters.

10. Kard

Another one of the best neo banks for teens is Kard. Like Pixpay, Kard is a French neo bank aimed at teens. Although Kard provides a physical card to its teen users, it does not offer a debit card. Unlike all the above neo banks, Kard provides credit cards to its users.

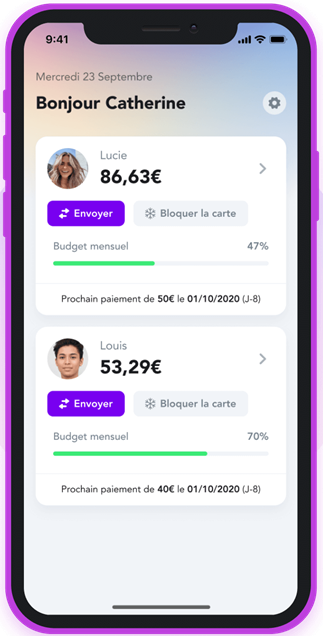

Like all the above neo banks, Kard lets parents have some control over their children’s expenditures. Only parents can transfer the money to their teen’s account. In this way, parents can provide their monthly allowance to kids on the app itself and make sure that their children aren’t spending more than needed. Further, there is no overdraft allowed, and hence teens can’t spend more money than what they have.

Kard also protects funds up to €100,000 as they are guaranteed by the Deposit and Resolution Guarantee Fund (FGDR). In order to make sure your kids are safe, there are some merchant categories that are blocked for minors, such as online betting and payment to sites prohibited for minors. Parents can also block the card in case it is lost or stolen.

Kard provides many features to its teen users. They can use their physical card to make online and offline purchases. They can also use the virtual card from the app to make online purchases. Teens also get immediate notifications on the app after every purchase and they can check their account balance at any time. The Kard credit card is a Mastercard that can be used to make purchases wherever Mastercards are accepted. The card can also be used abroad in all countries that accept Mastercards. Further, it can also be used to withdraw money from ATMs all around the world. Teens can choose their own customizable cards as well.

Using Kard to make payments also provides teens with cashback so that they can save money while purchasing from their favourite brands. Kard also has a referral system where teens can tell their friends about Kard. If they subscribe using their friend’s code, they get €5. Additionally, teens can secure the app by a passcode, fingerprint or facial recognition.

This has been a list of the top 10 best neo banks for teens. However, there are many more neo banks that are available to teens. Most of the banks mentioned here provide debit cards. This is because when one is just learning their way around finances, they should use debit cards rather than credit cards.

About the author

I am a student of Saint Xavier’s College, Mumbai.

I like playing and watching sports. I also like to read crime novels and mythological stories.

0 Comments